FAANG Engineers Should Rethink Their Investment Strategy

TL;DR: A seven-figure W-2 is a great springboard - but unless you trade some of that paycheck for ownership, the ceiling stays capped.

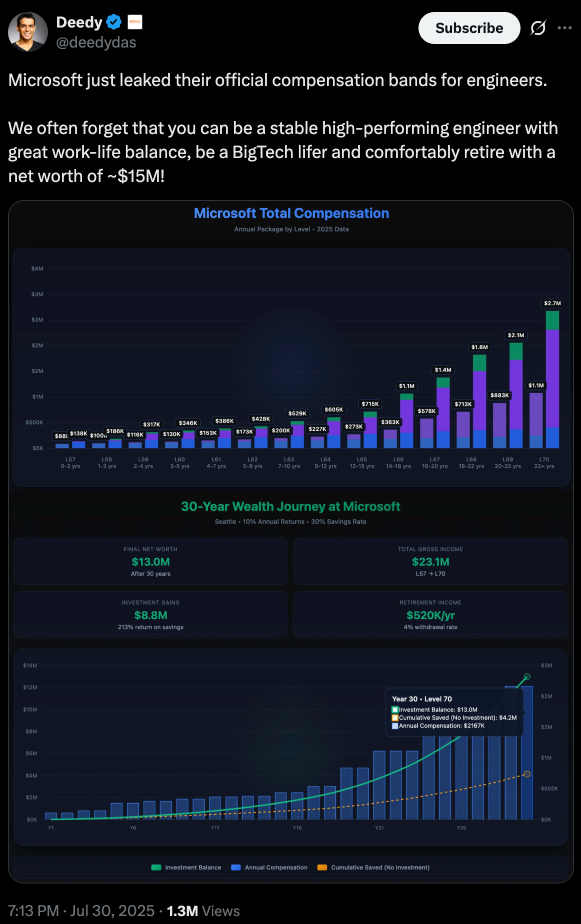

Picture this: you’re a Microsoft Distinguished Engineer (L70) pulling in $2.7M a year. You’ve hit the IC summit. You dutifully max every tax shelter, funnel the rest into index funds, and - just as Deedy Das’ comp slide predicts - retire 30 years later with $13M.

This is supposed to be the pinnacle of the “known” path to wealth. The safe, guaranteed route that every FAANG engineer aspires to.

Now I’m not so sure about this path. I believe FAANG Engineers and other high-wage earners can do better.

The Bogleheads Gospel at Work

Having spent many years in FAANG, I watched the same financial planning playbook repeat across internal forums and water cooler chat: max your 401(k), dump everything else into broad index funds, mega backdoor Roth, max out the HSA. The messaging was consistent - save 30% of your high six-figure or seven-figure income and you’ll hit $10M eventually. It’s the safe, responsible path.

This conventional wisdom dominated my work circles. When RSUs hit like clockwork every month or quarter, the advice was always the same: diversify immediately into VTSAX. Anyone suggesting individual stocks or angel investing was met with links to that one study about how 90% of day traders lose money.

But here’s what bothered me: we were all brilliant engineers solving complex problems at work, yet we’d outsource our entire financial future to Vanguard and follow the Bogleheads philosophy religiously. The mindset became “take your bets at work, don’t risk the golden goose.”

Two Views, One Message

Before we dive into numbers, notice the hidden premise both camps share: it’s not how much you earn, it’s what you own. One path treats salary as an endgame; the other treats it as rocket fuel. The difference sounds philosophical, but the outcomes can be material.

| Source | What the math says | What it really means |

|---|---|---|

| Microsoft comp leak | Save 30% of L57-L70 pay → $13M in 30 years | After taxes & inflation: $5-7M in today’s dollars |

| Financial Samurai article | Typical $30M+ portfolios | Only ~7% sits in index funds - the rest is business equity & real estate |

W-2 income - even seven figures - has a ceiling. Equity ownership breaks through it.

Rough equivalents to Microsoft L70 (“Distinguished Engineer”)

Translation for the ladder-climbers: Deedy’s $13M projection assumes you’ll scale a summit 99%+ of engineers will never reach - and even if you do, the view isn’t quite as panoramic as you’d hoped. See levels.fyi

| Company | Level | Title |

|---|---|---|

| L9 | Distinguished Engineer | |

| Meta | E9 | Distinguished Engineer |

| Amazon | L10 | Distinguished Engineer |

| Apple | ICT7 | Distinguished Software Engineer |

| NVIDIA | T10 | Principal / Distinguished Engineer |

(Amazon’s IC ladder caps at L10, though some orgs use L11 “Principal DE”; Apple’s ICT7 sometimes overlaps principal-level work.)

Why $2.7M/Year Still Isn’t Enough

W2 Tax Drag: Even in a bull market, the government is your biggest “co-founder.” Federal, FICA, and California state taxes shave off ~50¢ of every dollar before you ever hit Buy. And if California’s proposed 14.63% top bracket passes? Sharpen the blade.

Time-for-Money Trap: Your comp pauses when you take a sabbatical. Your roommate’s SaaS revenue or equity in a company doesn’t. The higher your salary, the scarier it feels to unplug - so you rarely do. I watched peers who could easily chubbyFIRE or leanFIRE stay chained to their desks because they couldn’t quite hit fatFIRE on index funds alone.

The Diversification Paradox: Your FAANG colleagues preach “don’t concentrate,” yet the richest people did exactly that - then diversified. Think Bezos keeping 90% Amazon until the yacht was paid for.

Bottom line: A supersized paycheck is defensive wealth. Ownership is offensive wealth. You need both, but only one can win a championship.

The Selection Bias Problem

There’s probably selection bias at play here - the types who join and stay at FAANG already chose the “safe” path. We’re the ones who picked the stable job over the startup, the guaranteed comp over equity lottery tickets. Plus, when you’re working 60+ hours chasing that next promo, there’s barely mental energy left to research asymmetric bets.

But that’s exactly the trap. We optimize for the wrong thing - maximizing W-2 income instead of maximizing ownership potential.

Two Kinds of “Rich”

We toss “rich” around like it’s binary, but lived experience says otherwise.

The Comfortably Rich ($1-10M)

- Dual-income professionals, 20+ years in tech

- 70%+ in index funds

- Nice house, Premium Economy flights

- Still fret over college tuition & healthcare

The Transformational Rich ($10M+)

When you hit eight figures, what you own shifts radically - per Financial Samurai’s reader surveys:

| Net worth | Business equity | Real estate | Public stocks* |

|---|---|---|---|

| $30M | 30% | 30% | 20% (~7% index funds) |

| $300M | 40% | 20% | 15% |

*Public-stock slices often include concentrated founder shares - not a three-fund portfolio.

Index funds preserve wealth; concentrated equity creates it. Nick Maggiulli’s “Wealth Ladder” framework puts this in stark perspective. He defines wealth in six levels, each a 10x jump from the last. Level 4 ($1M-$10M) gives you “travel freedom” - you can vacation wherever you want. Level 5 ($10M-$100M) provides “house freedom” - your dream home becomes possible without impacting your finances.

Here’s the uncomfortable truth: even if you hit that Microsoft L70 comp and save religiously for 30 years, you’ll likely land squarely in Level 5 but just barely - most will end up in Level 4. The traditional FAANG-and-index-funds path has a ceiling, and that ceiling sits below Level 5.

To break into Level 5 and beyond requires something different - concentrated ownership that can compound beyond what any salary, no matter how astronomical, can deliver. The gap between Level 4 and Level 5 isn’t bridged by saving another 10% or getting one more promotion. It’s bridged by ownership.

My Asymmetric Wealth Playbook (The 90/10 Rule). Here’s the framework I wish someone had shown me earlier: if you’re earning FAANG-level comp, you can easily save your 30% for that “guaranteed” retirement AND still have serious capital left over for asymmetric bets.

The 90/10 Split:

- 90% goes to the traditional path (401k, index funds, mega backdoor Roth)

- 10% of gross income goes to asymmetric bets

At senior levels, that 10% could be $200K+ annually. Write $25K checks for angel investments, small rentals, or side projects. Over 30 years, that’s 80-100 bets. Even if all but one goes to zero and the last one goes 100x, that winner pays for everything. This is literally the VC model - power law returns where one unicorn makes the entire portfolio.

The Three Phases:

-

Fuel the Rocket - Keep W-2 cash flowing; save 30-60%. Think of this as stacking solid rocket boosters.

-

Light the Booster - Direct that 10% into asymmetric bets while salary covers the downside: angel checks, small rentals, nights-and-weekends SaaS.

-

Stabilize the Orbit - When something hits, harvest gains (QSBS, 1031 exchanges), then add index funds for wealth preservation so market swings don’t rip your solar panels off.

If every bet zeros, fine - I’m still on pace for $13M at 60. If even one wins, I punch through the income ceiling that salary alone could never breach.

Real-World Patterns (Financial Samurai Readers)

Here are a few real-life examples shared by readers in the Financial Samurai community:

| Starting point | Concentrated move | Outcome |

|---|---|---|

| Google L5 | $200K seed into a friend’s startup (Uber) | $40M at IPO |

| Meta PM | Four Bay-Area rentals, 75% LTV | $5M equity in 10 years |

| Amazon SDE | Side-hustle SaaS → $50K MRR | Sold for $15M |

Common thread: They kept the day job until upside was real. Salary was a risk-buffer, not the prize.

The Psychology of Swinging Big

The hard part isn’t finding opportunities - it’s rewiring a high-earning brain conditioned to equate stability with virtue. When RSUs hit like clockwork, risk looks irresponsible. But:

- Getting laid off at 55 with golden handcuffs? Also irresponsible.

- Missing the window to exercise creativity (and mistakes) while energy is high? Same.

- Outsourcing your richest years to Vanguard and hoping the Bogleheads were right? You get the idea.

Caveat: Asymmetry isn’t YOLO. It’s capped-downside, uncapped-upside. If a single busted deal torpedoes your retirement, you bet wrong. The beauty of the 90/10 split is that your downside is truly capped - worst case, you still retire with $10M+ from your index funds.

Bottom Line

Index funds preserve wealth; concentrated equity creates it.

A FAANG paycheck is rare rocket fuel - but only if you pour some of it into rockets you actually own. Otherwise you’re just leasing horsepower and calling it freedom.

The conventional Bogleheads wisdom isn’t wrong - it’s just incomplete. Yes, max that 401(k). Yes, build that index fund foundation. But once the defensive lines are drawn, ask yourself:

What slice of my future is still on offense?

The answer - not your salary - will decide whether you retire comfortable or transformational.

Enjoy Reading This Article?

Here are some more articles you might like to read next: